The startup landscape of robotics is vast, so rather than trying to collect a bunch of meaning-less logos together of which you recognize half, we will instead take a segment by segment approach to organize the robotics industry.

Specifically, we’ll look to uncover, how much funding and tangible success (in the form of exits) has accrued to each of these applications.

The Factory Automation Stack

37% of all industrial robots installed worldwide are in the automotive sector. But any robotic factory will have the same characteristics, here are the businesses that come together to create robotic factories.

HARDWARE

Robot Manufacturers:

Robot manufacturers make robots, control systems, and platform level software for control of their hardware. Most of these companies have been long established, founded in the 70s — 90s and dominating the industrial robotics space.

Example companies: FANUC (market cap $27 billion), ABB (market cap $103 billion), Mitsubishi Electric (market cap $34 billion), Kawasaki Robotics (market cap $6.5 billion), DENSO (market cap $9 billion).

There are also robotics manufacturers who produce more research friendly and cobot oriented robots have a similar profile if a slightly smaller market — Universal Robots (market cap $1.5 billion).

Robotic Components Manufacturers:

Components manufacturers make specialized components for robots, often end-effectors or sensing systems. These companies will try to dominate the market in one skill whether it’s a dexterity related skill or perception based skill (for example a unique set of sensors to enable autonomy).

These companies were founded in the 2000’s when industrial automation had experienced wide adoption, the low hanging fruit had been automated and there was opportunity for new sensors and grippers to unlock new applications.

We are early in the game to see how these robotic tools businesses will play out.

Example companies: The company Soft robotics makes novel grippers & autonomy software for grasping soft objects (raised 26M Series C), Toposens makes sensors for robot autonomy (raised 4M seed round), Shadow Robot makes robotic hands pictured below (funding undisclosed).

HARDWARE + SOFTWARE

Robot Integrators:

Robot integrators are the companies that automate your factory line for you. They audit the current manufacturing process, design the robotic system, and deploy that system. Integrators typically also install the software for ongoing monitoring & control of that system, but don’t build these systems themselves.

These are services business.

Example companies: JR Automation (acquired by Hitachi for 1.425 billion in 2019), ASG, Reis Robotics (Acquired by KUKA amount undisclosed) , Acieta (acquired by Mitsui & co), Siemens

Observation — Many of these integrator businesses were swept up and acquired by the robotics manufacturers, this makes sense in that owning the full stack automation service helps you sell more of your robots.

SOFTWARE

Robotic Simulators & programming tools:

Robotic simulators allow users to simulate, program, and optimize industrial robot applications offline without disrupting production.

These 3D modeling + physics engine tools allow you to import all relevant CAD files, program paths across all robotic arms and simulate the sequences you want to run with no risk of collision. This is particularly critical in programming co-bot (collaborative robot, multi robot) systems.

Aside — Many believe that the unlock for creating AI systems to control robots is simulation, and these industrial simulators have a wealth of real data in this category.

Example companies: RoboDK (funding unknown), Gazebo (open source), Cadence Design Systems (market cap of $87B, do many things) , Simscape multi body (created by Matlab), Isaac Sim (created by NVIDIA), FANUC ROBOGUIDE, Flowstate by Intrinsic AI (started by Alphabet)

Observation — Interesting that there haven’t been many startups accruing value in this space just platforms created by the big players and open source tools.

Robot Operating Systems (ROS)

You can think of ROS as the lowest level software for robots, analogous to what CUDA is for NVIDIA GPUs. But unlike CUDA this is a non-proprietary industry-wide software

It allows developers to write robot software without needing to know the specifics of the underlying hardware. These libraries provide easy control of joint angles, movement, and failure recovery.

ROS also offers communication protocols for how robots should interact with other systems.

ROS is an open source project that was first a non-profit before it was acquired by Alphabet. Still the dominant platform for robot programming. Rhombus is an alternative, also an open source product.

The Warehouse Automation Stack

The second wave of robotic automation took place in warehouses.

Factories are the most controlled and constrained environments, which was why they were the primary automation target. The warehouse was the next challenge, requiring the addition of navigation, and tackling of a fundamentally less constrained problem.

For this reason you see little overlap between the companies targeting the two sectors.

Warehouse robots are all about mobility.

Warehouse Fleets

Robotic fleets companies provide hardware and often full stack solutions for warehouse automation. The two companies mentioned below focus on locating the target object in the warehouse, and bringing that object to a central picking location.

Startups: Locus robotics (raised an $117M series F), KIVA (Acquired by Amazon for $775 million), Symbotic is the largest of the warehouse automation companies with a market cap of $21 billion.

Pick and place ‘in a box’:

The other component of object retrieval is pick and place. This is an area that robotics startups have been able to build a lot of value.

The primary form of pick and place was station based in which you have a station optimized for pick and place with items coming to you. The more recent wave has been more complex pick and place such as truck unloading.

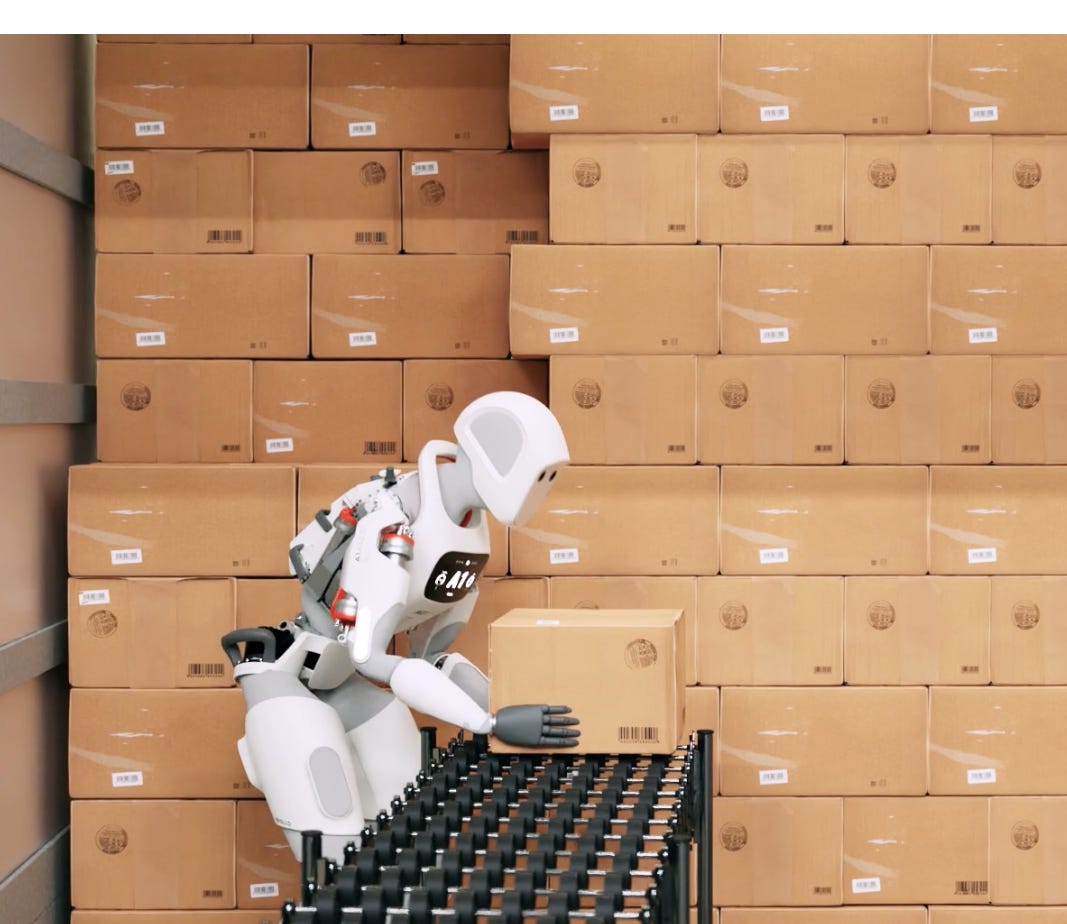

Startups: Covariant ($222 million raised to date) is an autonomous pick and place company. Nimble Ai ($65 million series B) is building their own robotic warehousing solutions for CPG and consumer brands. Apptronik ($32.8 million) is working to create the next generation of this in the form of a humanoid. Pickle Robots is building robots for truck unloading (raised a $26 million series A in 2022)

Robotic Warehouse Management Software:

Warehouse management software is needed when you are using multiple robotic solutions, maybe that’s pick and place + item retrieval to coordinate robotic activities. This is the hive-mind of your automated warehouse, and its actually one of the most important components. Think of this as a digital twin of your warehouse that controls the tasks of your robots.

Startups: InOrbit digital twin software for robots shown below, tracks product as it moved through a warehouse ($3.3 million seed in 2023), Unmanned Life does the same offering a cross hardware robot management solution ($4.8 million seed in 2022), Dexory (previously known as BotsAndUs) ($13 million in 2022) captures real-time insights for warehouses using fully autonomous robotic fleets.

Observation — if you look at the value accrued by companies in each of the above categories it tells an interesting story.

The first startups to build meaningful value were the startups solving the warehouse navigation problem, in one way or another they would ‘carry the boxes for you’. The next set of companies tackled pick and place.

We have yet to see the exits, but the valuations in the space suggest meaningful value. The final category, Warehouse Management, has only become necessary because of the success of the earlier two categories of warehouse robots.

Increasing automation will make businesses like these increasingly valuable.

Healthcare Robotics

The healthcare robotics is not an autonomy game but rather for a game of precision, ease and dexterity. All of these surgical robots are manually controlled meaning that there is no cognitive intelligence risk.

Observation -The Da Vinci robot is a general platform for surgery and thus has a huge market but as with any platform solution, there is opportunity in specialization.

Startups: Intuitive Surgical ($141 billion market cap) is the creator of the Da Vinci robot for robotic surgery. Moon surgical ($55.4 million raised) is creating robots for surgery, Wandercraft ($45M series C) develops an exoskeleton for inpatient rehab and outpatient daily life, CMR Surgical ($164M Series D) develops robots for endoscopic surgery

Construction Robotics

Startups: Monumental AI ($24M seed) is creating autonomous bricklaying robots, Built robotics ($112 million) built an autonomous pile driver. Icon ($451.5 million raised) is ‘3D printing’ homes.

Lab Automation Robotics

Startups: Reshape Biotech ($20M Series A) is building lab automation robots, Opentrons ( $240 million raised to date), Automata ($99.8 million raised to date).

Underwater Robotics:

The underwater robotics industry has tackled the problem of building tools for uninhabitable environments doing everything from imaging & sensing, to manipulation. The big consumers of this technology include oil and gas, ocean construction, and military.

Startups: Kraken Robotics ($209 million market cap) builds a wide variety of underwater autonomous vehicles and robotic manipulators, Terra Depth ($30.1 million raised) is autonomous underwater vehicles (AUVs) for ocean data collection and research. Neptune ($17.3 million raised) robotics developing hull cleaning robots that can operate above and below water to remove fouling while protecting anti-fouling paint.

Agriculture Robotics

Agriculture robots are taking on problems ranging from harvesting, to weeding, to spraying fertilizer, to collecting data on crops. Crop field autonomy is a logical step up from warehouse autonomy.

Startups: Saga robotics makes farming robots (11M Series A), Abundant Robots has raised $12 million in funding to build robots that pick strawberries, Mineral was a google X company that was creating autonomous systems for crop data collection, but eventually pivoted to adding their sensing suite onto existing equipment (as shown in image above). Guardian Ag ( $35 million raised to date), one of our portfolio companies, is building autonomous drones that spray fertilizer on large fields.

Home Robotics

Matic’s home robot is quite cute. Looks like a bulldozer toy.

Home robotics is the long established market dominated by vacuum cleaners and more recently lawn mowers. This space has been largely stagnant, as it is quite difficult to put machines in people’s homes, and consumers are a fickle group to sell to. I’m optimistic that there are more processes that can be automated in the home.

Startups: iRobot builds the autonomous vacuum cleaners that created the home robotics market ($385.35 million dollar market cap), Matic ($30 million raised to date) is another home cleaning robotics company that builds an autonomous vacuum with “the most advanced 3D mapping and spatial technology on the market”. Electric Sheep ($21.5 million dollars raised to date) is building autonomous lawnmowers.

Robotic Foundation Models:

Most of the startup landscape is targeting solving a tactical problem with robots. But there are some companies making a bet that building the best control technology will aggregate value.

Targeted Foundation models:

Covariant is making foundation models for pick at place.

Field AI ($30.2M series A) is creating Field Foundation Models (FFMs) which is a model focused on robot autonomy.

General Foundation models:

NVIDIA created a project called Gr00T a general-purpose foundation model for humanoid robots.

Skild, a startup out of Carnegie Mellon that foundation models robots control, is raising $300 million from Lightspeed Venture Partners, Coatue and others at a $1.5 billion valuation.

Collaborative Robotics raised $100 million in a Series B led by General Catalyst is also making a software foundation model for robots.

Field AI ($30.2M series A) is creating Field Foundation Models (FFMs) which is just a different take on a robotic foundation model. Figure (675M) is developing Robotics foundation models + humanoids for robot control.

Everyday Robotics a Google X company and has also been a major contributor to the RT1 & 2 Papers.

Humanoids

I know what you’re thinking.

She’s forgetting humanoids?? There is far to much to be said. Check out part 2 for more on that.

In Summation.

There are many plays in robotics that have grown into successful and massive businesses. Most of these make money automating narrow tasks.

Venture money is accruing to new strategies of model based control. This is a promising strategy, but the models must be robust, today almost no robotics systems use pure model based control. Demos mean little in the game of automation. I look forward to seeing customers and data.

I prefer to see targeted strategies aiming to automate tasks, that inch down the complexity road. (aka an increase in complexity akin to the factory -> warehouse jump)

Automation markets are big because they replace people, and people are often the most expensive part of a business. There is plenty left to automate, from repair, to cleaning, to rescue, to space manipulation.

I look forward to meeting roboticist solving those problems.

This is an awesome article! Thank you so much for this breakdown.